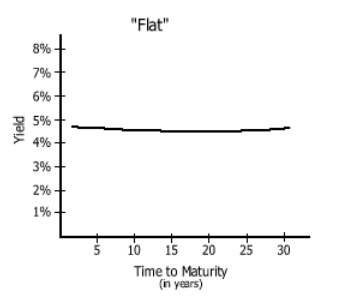

If short term interest rates are lowered to approximately zero percent, how does this impact the Bond Yield Curve (is it normal or inverted)? Draw the curve, with the axes labeled properly.

Sources of Short-Term Financing (Chapter 8) (Chapter 6 – pages 151 – 155) Short-Term Vs. Long-Term Financing Approaches to Financing Policy Trade Credit. - ppt download

Russia External Debt: Short Term: Within 1 Year: Residual Maturity (RM) | Economic Indicators | CEIC

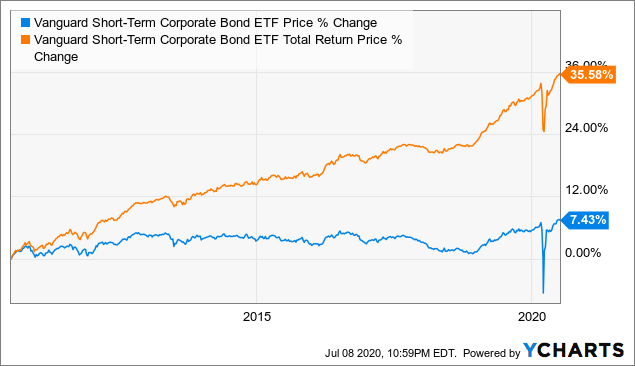

Vanguard Short-Term Corporate Bond ETF Is A Better Choice Than U.S. Treasuries (NASDAQ:VCSH) | Seeking Alpha

shows the Yield Curve obtained by the difference between long-term and... | Download Scientific Diagram

:max_bytes(150000):strip_icc()/Commercial-paper-4199154-FINAL-e3f80cbbd4ee424abe16e5ce4620bfd4.png)

:max_bytes(150000):strip_icc()/Treasurybill-b7a8fc4ccac04973867613f77851b732.jpg)

:max_bytes(150000):strip_icc()/YieldCurve2-362f5c4053d34d7397fa925c602f1d15.png)

:max_bytes(150000):strip_icc()/invertedyieldcurve_final-25d38e62233047bd9507553337f4413d.png)